Person-to-person loans, also known as P2P loans, do not come from traditional lenders such as banks, credit unions, and finance companies. Instead, you are borrowing money from another person or several persons. You will pay interest but the process of approving and getting the loan is much faster than a traditional bank loan.

What is P2P?

P2P loans become really popular recently. These loans have changed the world of lending because these can happen between any two people, including loans from friends and family. Each of the persons can set up a loan and the repayment arrangement, which is beneficial for both sides, preferably with a written agreement.

That said, P2P lending usually refers to an online service that handles all the logistics for both borrowers and lenders. In addition to providing agreements, payment processing, and borrower evaluation, P2P credit makes it easier for people to join. Instead of just borrowing from people you know or those in your community, you can access the company’s website and sign up to borrow from individuals and organizations nationwide.

Many websites have made P2P loans widely available. Prosper.com was one of the pioneers, but there are many others and new lenders appear regularly.

Why you would try a P2P lender instead of a traditional bank or credit union?

P2P loans can help with two of the biggest challenges borrowers face: costs and approval.

Lower Costs: P2P loans are often cheaper than loans available from traditional lenders, including some online lenders. Applying for it is usually free, and origination fees are usually around five percent or less on most loans. Perhaps most importantly, these loans often have lower interest rates than credit cards. The most popular lenders offer fixed income, so you have a predictable, level monthly payment. P2P lenders do not have the same overheads as the largest banks with extensive branch networks, so they pass some of these savings to borrowers.

Easier Admission: Some lenders just want to work with people who have good credit and the best debt-to-income ratio. But P2P lenders are often more willing to work with borrowers who have had problems in the past or who have been in the process of building credit for the first time in their lives.

With good credit and a strong income, loans are less expensive and that is also true with P2P lenders as well as traditional lenders. But in many communities, lenders who are interested in working with low-income borrowers or people with bad credit are usually charged much higher rates and fees. These borrowers then only have a few ways on how to payday loan related products.

Some P2P lenders, like Asteria, offer loans for people with credit as low as 520. Other P2P lender scores that can charge loans to people with a less than optimal credit score can charge 36 percent interest, but this still suggests a loan Payday.

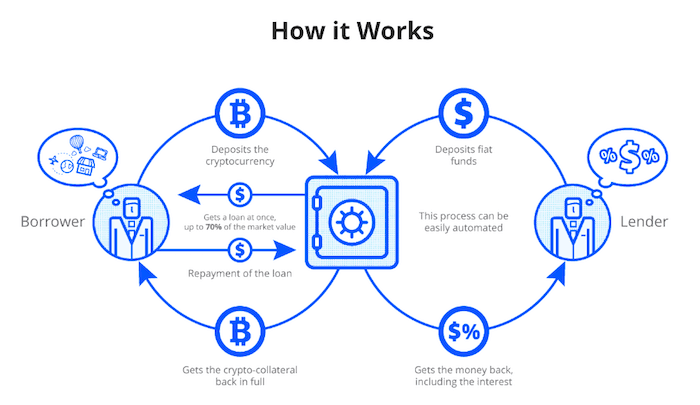

How does it work?

Every P2P lender is different, but the idea is that there are many people who borrow money and they are looking for borrowers.

These people would like to earn more than they can get from a savings account and they are ready to make reasonable loans. P2P sites serve as market borrowers and lenders to connect. Prosper.com models itself after an “eBay for loans.”

Qualifying: Different services have different requirements, and lenders also set limits on how much risk they are willing to take. For most major P2P lenders, several risk categories are available to investors. If you have high credit scores and income, you will fall into the lower risk categories. Some lenders look at “alternative” information such as your education and work history, which can be very useful if you have a limited credit history.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024