Cash flow is crucial for any business. Without enough cash, companies can struggle to operate effectively and invest in growth opportunities. Cash flow problems can lead to operational disruptions and strained vendor relationships.

One major cause of cash flow issues is inefficiency in handling deductions. Even companies with many invoices can face cash flow problems if they don’t manage deductions quickly and effectively.

How Deduction Management Inefficiencies Hurt Cash Flow

Managing deductions involves many tasks, from identifying and disputing deductions to resolving disputes and reconciling accounts. Delays and miscommunications in this process can slow down cash recovery.

Traditional methods, like using phone calls, emails, and mailing documents, are prone to human error and can take a long time. These inefficiencies result in delayed payments, more disputes, and a lack of visibility into outstanding deductions.

Improving cash flow requires making the deduction management process more efficient. Automated deduction management solutions help businesses free their teams from routine tasks, reduce disputes, and improve overall financial performance.

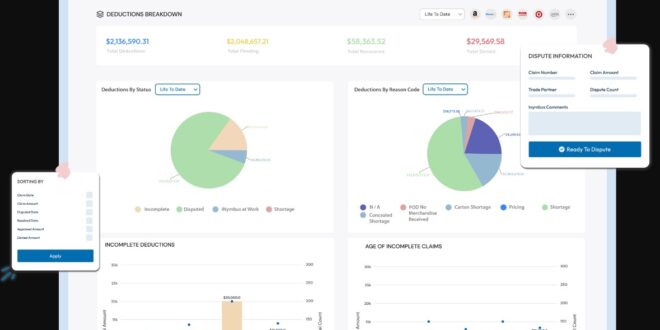

What an Automated Deduction Management Solution Looks Like

Many businesses are turning to automated deduction management solutions to improve efficiency and cash flow. These solutions streamline key tasks in the deduction process:

- Identifying and categorizing deductions ─ Software automatically identifies deductions from accounts receivable data using predefined rules. It categorizes them electronically, speeding up the process. This includes handling specific types of deductions like Target shortages and Walmart chargebacks.

- Gathering and organizing documents ─ Automation collects and organizes all necessary documents for each deduction, reducing errors and speeding up dispute resolution.

- Disputing invalid deductions ─ Automation matches deductions with supporting documents and submits disputes based on predefined rules, saving time and reducing errors.

- Facilitating collaboration ─ Automated solutions provide a centralized platform for sharing documents and resolving issues, improving communication and reducing friction.

- Data retrieval ─ Integration with ERP or accounting software retrieves financial records accurately.

Benefits of an Automated Deduction Management Solution

Automated deduction management solutions offer numerous benefits that impact cash flow and operational efficiency. By automating and streamlining the deduction management process, businesses can unlock improvements in key areas and do more with less:

- Reduced manual work ─ Automation significantly cuts down on the time spent identifying, categorizing, and disputing deductions. This lets your team focus on more valuable tasks.

- Faster recovery ─ Automated processes speed up recovery times, improving cash flow as funds are received more quickly.

- Fewer past-due deductions and disputes ─ Automated processes reduce the number of overdue deductions, helping maintain positive cash flow.

What to Look for in an Automated Deduction Management Solution

When choosing an automated deduction management solution, consider these key factors:

- Integration with existing systems ─ The solution should integrate seamlessly with your current ERP or accounting systems.

- Scalability ─ Choose a solution that can handle increasing transaction volumes and adapt to your business growth.

- Reporting and analytics ─ Comprehensive reporting and analytics capabilities enable data-driven decision-making and continuous improvement.

iNymbus is the perfect solution with all the above features. See how we helped this supplier, who was dealing with 20+ retailers, automate disputing deductions on the Lowes Vendor Portal.

Conclusion

Automated deduction management software can greatly reduce manual work, minimize errors, and speed up the deduction management process. This leads to better cash flow and overall operational efficiency. Investing in the right solution can transform how your business handles deductions and improve cash flow management.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024