In the volatile, rapidly evolving world of cryptocurrencies, the prospect of swift profit generation has driven countless individuals to the digital financial frontier. Bitcoin, as the flagship cryptocurrency, remains the gold standard and the first point of contact for many aspiring investors.

This post explores strategies designed to fast-track your Bitcoin earning potential. We will venture through risk assessment, exchange leveraging, trading techniques, altcoin selection, and market timing. Our journey culminates in scalping – a method promising quick profits.

The aim is to offer a comprehensive yet digestible guide to help both beginners and seasoned traders maximize their returns from Bitcoin and other cryptocurrencies.

Leveraging Cryptocurrency Exchanges for Quick Gains

Digital asset exchanges provide a platform for fast profit generation. They operate around the clock, unlike traditional markets, and offer a plethora of trading pairs to capitalize on. By learning to leverage these exchanges effectively, traders can earn Bitcoin more swiftly.

Crypto exchanges offer numerous advantages for speedy profit generation. Among them, the ability to engage in margin trading stands out. This strategy allows traders to borrow funds and trade larger amounts, potentially leading to significant gains.

However, one must remember that while this tool amplifies potential profits, it similarly escalates potential losses. Hence, effective leveraging of cryptocurrency exchanges requires a clear understanding of these nuances and careful management of potential risks. The right platform is crucial in trading so make sure you try out https://immediate-momentum.io/.

Assessing Risk Tolerance: Setting Your Profit Goals

Venturing into the Bitcoin market, an indispensable first step involves assessing your risk tolerance. Your risk appetite defines the boundaries of your trading strategy and sets your profit targets. This personal introspection facilitates an understanding of how much capital you’re willing to risk and what profit margins you’re aiming for.

Not all investors possess the same financial endurance. Some might be comfortable staking large sums in high-risk, high-return strategies, while others may prefer a more conservative approach. Establishing these boundaries early on helps you select a strategy aligning with your risk profile.

Whether your aim is making small, steady gains or hitting the occasional jackpot, knowing your risk tolerance will guide your profit generation goals and help keep your trading pursuits sustainable.

Day Trading Strategies: Capitalizing on Short-Term Fluctuations

Day trading, a strategy where positions are opened and closed within a single trading day, capitalizes on the Bitcoin market’s inherent volatility. This approach provides ample opportunities for swift profit generation, as Bitcoin often experiences significant price swings throughout the day.

However, successful day trading demands constant attention and swift decision-making. Traders must stay abreast of market trends, news, and indicators that can influence Bitcoin’s price. Tools like technical analysis, trading bots, and risk management strategies can be immensely beneficial. Yet, these methods come with their own set of risks, making it crucial for traders to understand their workings before incorporating them into their trading routine.

Swing Trading Techniques: Profiting from Medium-Term Trends

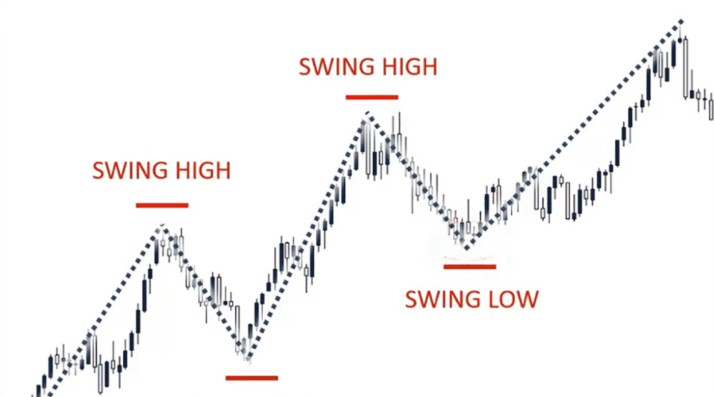

Swing trading, which involves holding positions for days or weeks, attempts to profit from medium-term market trends. Unlike day trading, this strategy doesn’t require constant market monitoring, making it more manageable for those unable to devote large portions of their day to trading.

While swing trading eliminates the need for constant market monitoring, it still demands a robust understanding of market indicators and trends. Successful swing traders identify substantial price swings and time their trades to capitalize on these movements.

As this method involves holding positions longer, it potentially exposes traders to greater market risk. Therefore, having a well-thought-out exit strategy is crucial to protect profits and limit losses.

HODL vs. Active Trading: Finding the Right Approach

Two dominant approaches stand out: HODLing (holding on for dear life) and active trading. The former entails buying Bitcoin and holding onto it regardless of market fluctuations, betting on long-term appreciation. The latter involves buying and selling Bitcoin based on short-term market movements to earn quick profits.

While HODLing is a passive strategy requiring less time and expertise, active trading can be more lucrative if executed correctly. Yet, it’s worth noting that the latter approach requires considerable market knowledge, time investment, and emotional resilience to withstand market volatility.

Identifying which strategy aligns best with your risk tolerance, profit goals, and available resources is crucial to your Bitcoin earning journey.

Identifying Promising Altcoins for Fast Returns

Diversifying your crypto portfolio by including promising altcoins can often yield swift returns. Altcoins, cryptocurrencies other than Bitcoin, often display higher volatility, resulting in potentially larger short-term gains.

Investing in altcoins necessitates in-depth research and astute market observation. While many altcoins promise revolutionary technologies and strong growth prospects, not all fulfill their potential. Some may even turn out to be scams. Therefore, a balanced approach, featuring a mixture of Bitcoin and well-researched altcoins, can help boost your earning potential while spreading risk across different digital assets.

Timing the Market: Key Factors to Consider

When it comes to speedy profit generation, timing the market accurately is of paramount importance. Market timing involves entering and exiting trades based on predictions of future price movements. This strategy can yield substantial returns if executed correctly, especially in a highly volatile market like Bitcoin.

Even seasoned traders find it challenging to time the market consistently. Factors like economic indicators, market sentiment, and global events can significantly impact Bitcoin’s price. Therefore, it’s vital to stay informed about these factors and consider them in your trading decisions.

Remember, while timing the market can be profitable, it’s risky and should be attempted only after thorough research and consideration.

Scalping Bitcoin: Rapid Profits in Small Increments

Scalping, a trading technique targeting small, quick profits, often appeals to those seeking swift returns. This strategy involves making numerous trades throughout the day, capitalizing on minor price fluctuations. Scalpers typically aim for a high win rate rather than substantial profits from individual trades.

While scalping can result in consistent earnings, it requires a significant time commitment and intense concentration. Moreover, transaction fees can eat into your profits, so it’s essential to choose a platform with low trading costs. If you have the time and mental fortitude to embrace the high-stress, high-speed world of scalping, it can serve as an effective tool for swift Bitcoin generation.

Final Thoughts

It becomes evident that earning Bitcoin swiftly is an achievable goal, albeit one that necessitates strategic planning, market understanding, and risk management. Whether you choose day trading, swing trading, scalping, or a combination of strategies, success largely hinges on aligning these methods with your risk tolerance and profit goals.

Stay informed, stay vigilant, and remember that in the realm of cryptocurrencies, there are always new opportunities on the horizon. Happy trading!

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024