The key to a comfortable retirement isn’t a secret, it’s just hard to implement. It goes by the name of delayed gratification, or the practice of forgoing luxuries now to save that money for spending in the distant future.

The main problem here is that, as human beings, we are pretty much hardwired to want our gratification right now. Even if it comes at the expense of living out the final decades of our lives without the amenities we deserve.

It can be quite a challenge to ignore that French pastry in the window, even though it’ll run you over five dollars and you’re only a short walk from home. The same can be said for bigger purchases, like cars and houses, because owning them signals that you have reached a certain status in life. The question is, can you afford them without having to work until you’re sixty-five? If you stick to the following five spending tips, the answer will be a resounding yes!

Know Yourself

The first step on your path to accelerated retirement is understanding your relationship with money. If there’s cash in your wallet, will you always find a way to spend it just because it’s within arm’s reach? Or are you more the type to swipe a credit card throughout the day without feeling like it’s real money?

There are roadblocks you can put in place to curb this behavior and keep yourself from falling on hard times. It could be as simple as carrying the form of currency you are least likely to spend. You could also enlist a friend to go over your expenses every month to keep you accountable for unnecessary purchases. If you do find yourself in need of a temporary fix, see if a payday loan can be your bridge over troubled water. Working with a trusted online lender like GoDay can help provide financial support when you need it.

Built-In Leeway

Pick two days a month to treat yourself to something you love. Make sure it’s reasonably priced, but working it into your budget so you always have something to look forward to. Consider it your reward for keeping your finances on track. Here’s a handful of suggestions.

- An ice-cream cone at your local parlor

- A rickshaw ride across the neighborhood

- A drink with friends

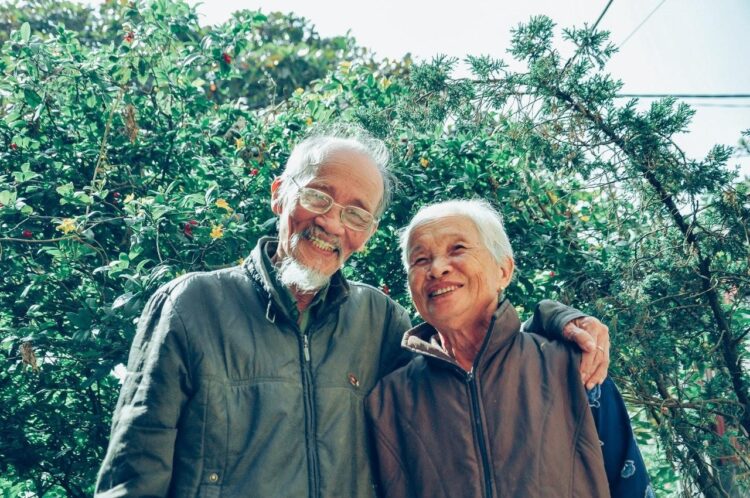

It’s important to make room for indulgences alongside responsible spending habits. Life is short and we should enjoy it as much as we can without jeopardizing our lifestyles as senior citizens.

Choose Money Over Time

When you’re focused on saving, reallocating your time can help you put more money away. It comes down to doing a little work instead of paying a premium for someone else to do it for you. Case in point: ordering takeout. There’s no sound reason to pay twenty or thirty dollars for dinner when you could unthaw some chicken and frozen veggies and cook yourself a meal for under five dollars a plate. Becoming an expert in the kitchen really pays off if cooking is a regular part of your schedule.

It’s a similar dilemma with public transit versus the convenience of ride-sharing. While the latter is certainly more comfortable than the former, it’s also many times more expensive. The frugal alternative—waiting for the bus—may involve a lot more waiting, but at least you’ll get paid to do it with the taxi money you’ve saved.

Pay Yourself First

Paying yourself first means taking a small percentage of every paycheck and investing it in a portfolio of financial instruments that will grow in value over time. The most common are stocks and bonds.

The money you contribute to your investment account grows on its own while you’re free to focus on family and your career. What you’re blessing yourself with here is an additional stream of income, one that will turn into a nice nest egg over a few decades. When you’re ready to retire, your hard-earned savings will protect you from any financial emergency.

Of course, if money is tight, your basic necessities and current liabilities are the highest priority. If you need the extra support, research payday lenders with a reputation for helping customers through life’s temporary setbacks.

Embrace the Generic

Many fail to account for the difference in price between a brand-name product and its generic alternative. It may seem like the high-end bar of soap is only forty cents more than the bulk brand. It may also feel like generic aspirin, though cheaper, won’t be as effective as the pills from the company that owns the rights to the ‘Aspirin’ name. What gets lost in the decision is how the price premium can reach twenty-five percent or more!

Once you do the math, it all becomes clear. It is outrageous to pay five dollars for every twenty you spend, just to enjoy the prestige of a brand-name lifestyle. The truth is, the cheaper soap will do a good job, and the generic aspirin will make your headache go away. Be practical and use those savings to extend your golden years and make them as exciting as they can be.

It’s only by optimizing every financial decision that you can truly take control of your money. That means thinking about the best way to spend every dollar before handing it over. And you can only know what’s best for you if you have clear-cut financial goals to guide you into the future. As a base case, providing for your spending needs in old age should certainly be one of them.

It can seem pointless, a downright waste, to not pay up and enjoy life now when the expensive concert ticket or tropical vacation is only one click away. But this is just an illusion. In most cases, your days as a granny or grandpa are simply too far away to feel worth caring for. You can’t be certain about what your life will be like in a generation, but chances are you’ll be around to find out. The trick is accepting that you cannot predict how you’ll change into old age and saving precisely because the future is uncertain. Prepare for any eventuality and it’ll be smooth sailing come what may.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024