Mobile payment solutions, like Apple Pay and Google Wallet, are gaining popularity, while traditional payment methods, such as credit cards and bank transfers, remain steadfast.

Some apps combine different payment processors, which makes them quite convenient. They are also simple to use, you can just tap to pay with phone when using them.

Choosing between these options can be challenging. Here are seven tips to help you navigate the decision-making process.

1. Understand Your Customer Base

- Know your audience ─ The first step in choosing the right payment solution is understanding your customer base. Are your customers tech-savvy millennials or older individuals who prefer traditional payment methods?

- Survey your customers ─ Conducting surveys or analyzing purchase patterns can provide insights into their preferred payment methods. Offering the payment options that align with their preferences can enhance customer satisfaction and increase sales.

2. Evaluate Security Features

- Mobile payments ─ Mobile payment solutions often come with advanced security features, such as biometric authentication (fingerprint or facial recognition) and tokenization, which replace sensitive information with a unique identifier.

- Traditional payments ─ Traditional payment methods, like credit cards, also offer robust security measures, including EMV chip technology and fraud detection systems. However, these methods may be more vulnerable to certain types of fraud compared to mobile payments.

- Compare and decide ─ Evaluate the security features of both mobile and traditional payment solutions to determine which offers the best protection for your business and customers.

3. Consider Transaction Fees

- Mobile payments ─ Mobile payment solutions typically have lower transaction fees compared to traditional methods. For small businesses or those with tight margins, these savings can be significant.

- Traditional payments ─ Credit card processing fees can be higher, and additional charges may apply for international transactions or currency conversions.

- Analyze costs ─ Compare the transaction fees of various payment solutions and consider the volume and type of transactions your business processes to determine which option is more cost-effective.

4. Look at Integration and Compatibility

- Mobile payments ─ Mobile payment solutions can be seamlessly integrated into e-commerce platforms, mobile apps, and point-of-sale (POS) systems, offering a smooth user experience.

- Traditional payments ─ Traditional payment methods may require additional hardware or software integration, which can be more complex and costly.

- Assess your needs ─ Consider the ease of integration and compatibility with your existing systems when choosing between mobile and traditional payment solutions.

5. Examine the User Experience

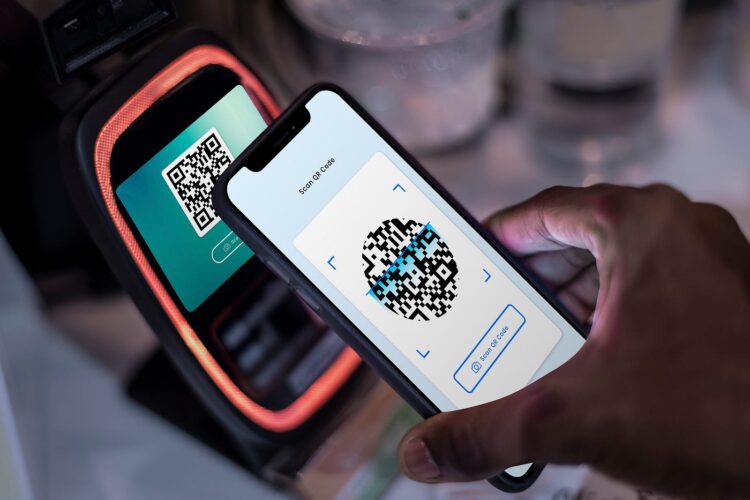

- Mobile payments ─ Mobile payment solutions offer a fast and convenient checkout experience, with users simply tapping their phone or scanning a QR code.

- Traditional payments ─ While still reliable, traditional methods can be slower, requiring manual entry of card details or physical signatures.

- Prioritize convenience ─ A streamlined user experience can lead to higher customer satisfaction and repeat business. Evaluate which payment solution offers the most convenience for your customers.

6. Check Availability and Reach

- Mobile payments ─ Mobile payment adoption varies by region and demographic. In some areas, mobile payments are widespread, while in others, they may be less common.

- Traditional payments ─ Traditional payment methods are universally accepted and familiar to most consumers, making them a safe bet for any business.

- Assess market trends ─ Consider the adoption rates of mobile and traditional payment methods in your target market to ensure you’re offering relevant payment options.

7. Plan for Future Growth

- Scalability ─ As your business grows, your payment solution needs to scale with it. Mobile payment solutions are typically more flexible and can easily accommodate growth.

- Flexibility ─ Traditional payment methods can also scale, but may require more investment in infrastructure.

- Future-proof your business ─ Choose a payment solution that not only meets your current needs but also supports your long-term growth objectives.

Conclusion

Choosing between mobile and traditional payment solutions requires careful consideration of your customer base, security features, transaction fees, integration capabilities, user experience, availability, and future growth plans.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024